Last week, Biden — in between losing his place during speeches and nearly falling down again on the steps of Air Force One — trotted out a $2.25 trillion spending bill the handlers are calling a ‘once-in-a-generation’ “investment” that will supposedly create the “strongest, most resilient, innovative economy in the world” (or, one that is very similar to what Donald Trump policies created during the first three years of his term).

However, a new study of the tax hikes contained in the wrongly-named American Jobs Plan will end up costing the economy far more than any benefits the country will receive from government spending amounting to hundreds of billions of dollars.

Fox Business Network notes:

The eight-year plan will make massive investments in the nation’s roads and bridges, as well as transit systems, schools and hospitals. It will be funded by raising the corporate tax rate to 28% from 21% – rolling back part of former President Trump’s 2017 tax cuts – and by increasing the global minimum tax on U.S. corporations to 21% from 13%.

But according to an analysis of Congressional Budget Office data published by the Tax Foundation, a center-right think tank, federal investments only deliver half the economic as private-sector investments — roughly 5% versus 10%. A dollar of federal spending results in only about $0.67 of actual investment because state, local and private sector entities reduce their spending in response.

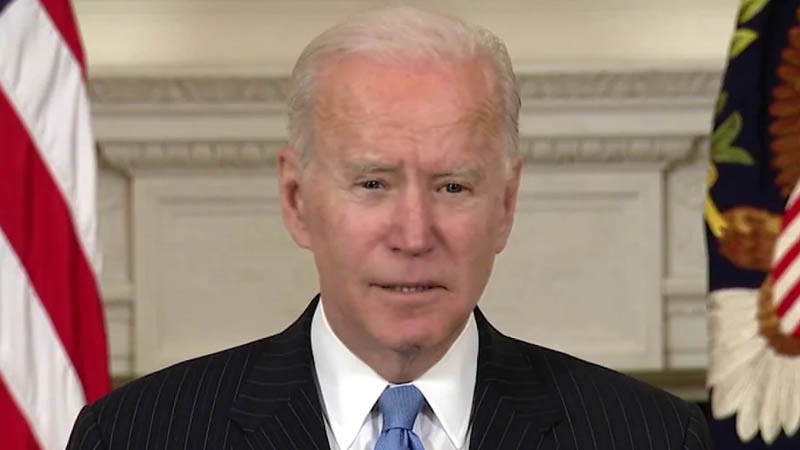

“Raising taxes will not slow the economy at all,” Biden lied Friday during remarks on the March jobs report at the White House. “We’re asking corporate America to pay their fair share. It will not slow the economy at all.”

Corporate America paid ‘their fair share’ for decades under liberal-progressive tax policies when the percentage was in the upper 30s. And even now, corporations are taxed at nearly one-quarter of what they earn, which is still several percentage points above other industrialized nations (like Ireland, where the corporate tax rate is 12.50 percent).

The CBO found a federal expenditure of $100 million would actually boost GDP by some $5 million, though a private investment of the same amount would boost GDP by $10 million.

“By that metric, the $2.25 trillion in government spending backed by Biden will result in just $1.3 trillion in actual investment, one-third less than the headline amount,” Fox Business Network added.

The Tax Foundation adds: “Since $1 in government investment delivers only half of the returns of $1 in private investment, the economy would be better off if the $2 trillion in taxes that President Biden wants to finance his package were left in the hands of the private sector.

Add to the lack of return the fact that the spending will add trillions to the national debt, where experts are already warning that an interest rate hike of just a few percent will devastate the federal budget.

Some lawmakers have recently sounded the alarm over it.

“It’s a cheap time to borrow and some people are using that as a reason to borrow. The problem that comes is our interest rates flow. The U.S. has the ultimate adjustable-rate mortgage, which is the rates can change,” Sen. Angus King (I-Maine) said last week.

“And if the rates go back to 4 to 5%, which is where they’ve been historically, we’re in a heap of fiscal trouble. The math is pretty easy. Every 1% is $250 billion a year of interest costs. So 4% is $1 trillion dollars; 5% is $1,250,000,000,000, which happens to be the entire current discretionary federal budget.”